OpenClaw Boosts Mac Mini Sales — Why Apple Isn’t Building Its Own AI Agent

The 2026 breakout hardware hit isn’t a new iPhone or Vision Pro — it’s the long-overlooked Mac Mini, supercharged by OpenClaw.

The Unexpected Surge

Who would’ve predicted that the first major hardware success of 2026 would be the Mac Mini — a historically under-the-radar device in Apple’s lineup — catapulted into mainstream demand by OpenClaw, an open-source AI agent?

OpenClaw enables fully autonomous workflows: drafting emails, managing calendars, executing cross-app tasks — all without user intervention. Its seamless integration with macOS has ignited unprecedented interest in Apple’s compact desktop, transforming it from a niche developer tool into a sought-after AI workstation.

The Strategic Paradox: Why Apple Won’t Build Its Own OpenClaw

Apple possesses unparalleled advantages:

– A unified hardware-software ecosystem (iPhone, Mac, iPad, Watch),

– Deep user data access (with privacy consent),

– And decades of experience shipping “magical” out-of-the-box experiences.

So why hasn’t Apple launched an official, Siri-powered AI agent — a “Super Siri” — monetized as a premium service (e.g., $199/year)?

As Y Combinator partner Jake Quist notes: An Apple-native AI agent could forge the most defensible moat in tech — leveraging cross-device context, user habits, and ambient intelligence no competitor can replicate.

Yet Apple remains conspicuously silent. Here’s why:

⚖️ Legal & Platform Risk: The Terms-of-Service Trap

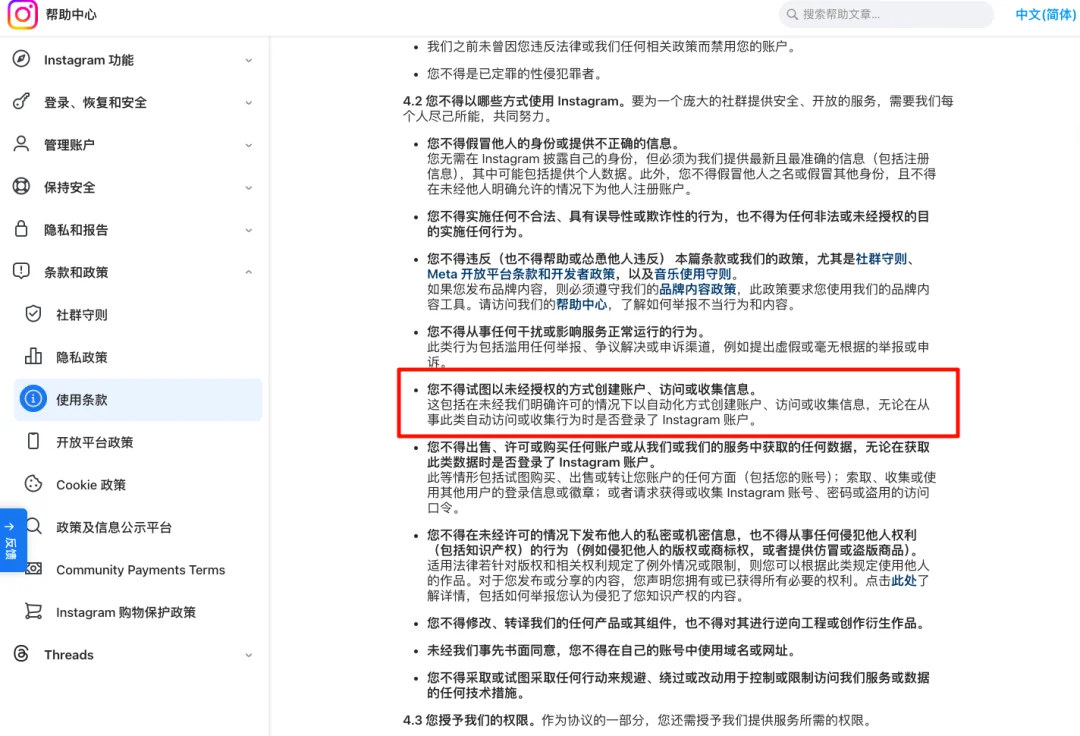

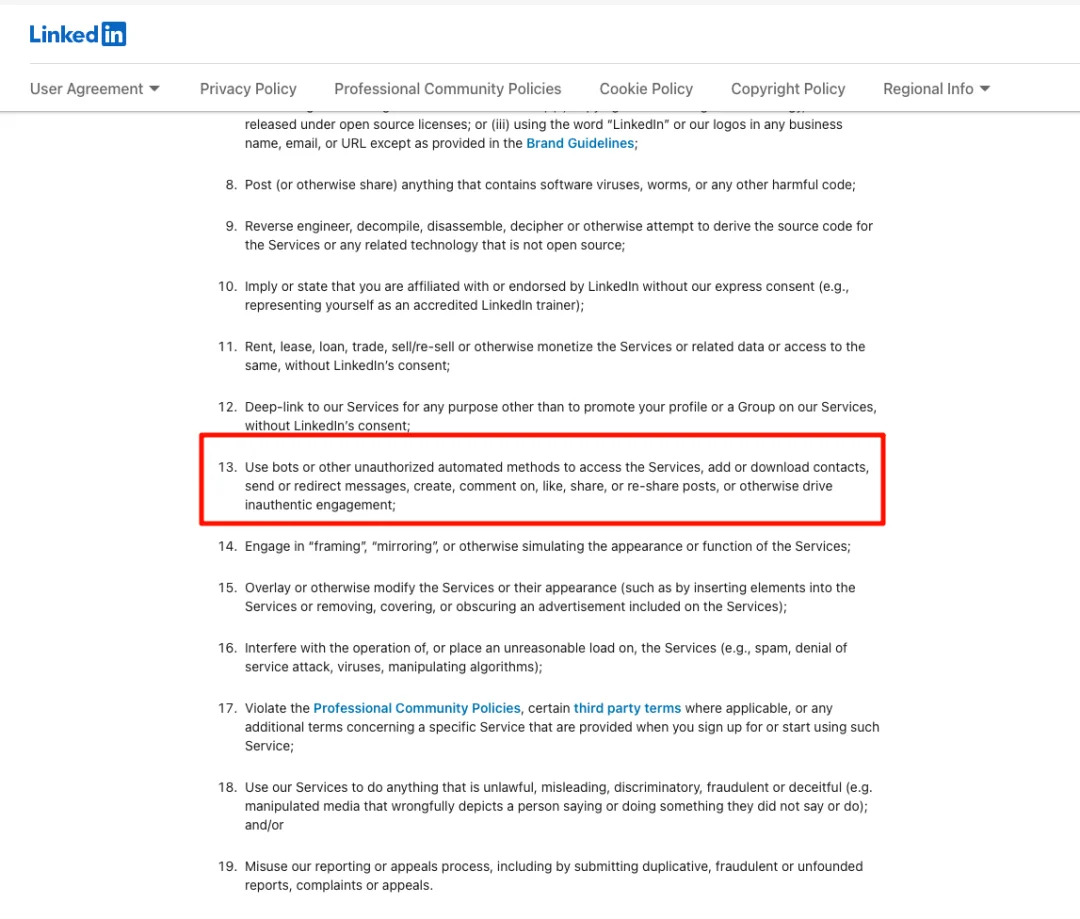

OpenClaw’s functionality often relies on browser automation — posting to Instagram, applying to jobs on LinkedIn, interacting with web forms. But platform terms explicitly prohibit automated actions:

- Instagram: Automation violates its Terms (Section 3.2) — risking account suspension.

- LinkedIn: Section 8.2 bans “automated scraping, crawling, or data extraction” — with aggressive enforcement history.

💡 Crucially, these rules target commercial entities — not individuals.

If Apple shipped such automation system-wide in iOS/macOS, it wouldn’t be “user convenience” — it would be systemic API circumvention, inviting immediate antitrust scrutiny and lawsuits from Meta, Microsoft, and others for unfair competition and tortious interference.

But when users install OpenClaw themselves on a Mac Mini? Apple is legally insulated: It’s just selling a general-purpose computer.

Apple’s Proven Playbook: The ATT Precedent

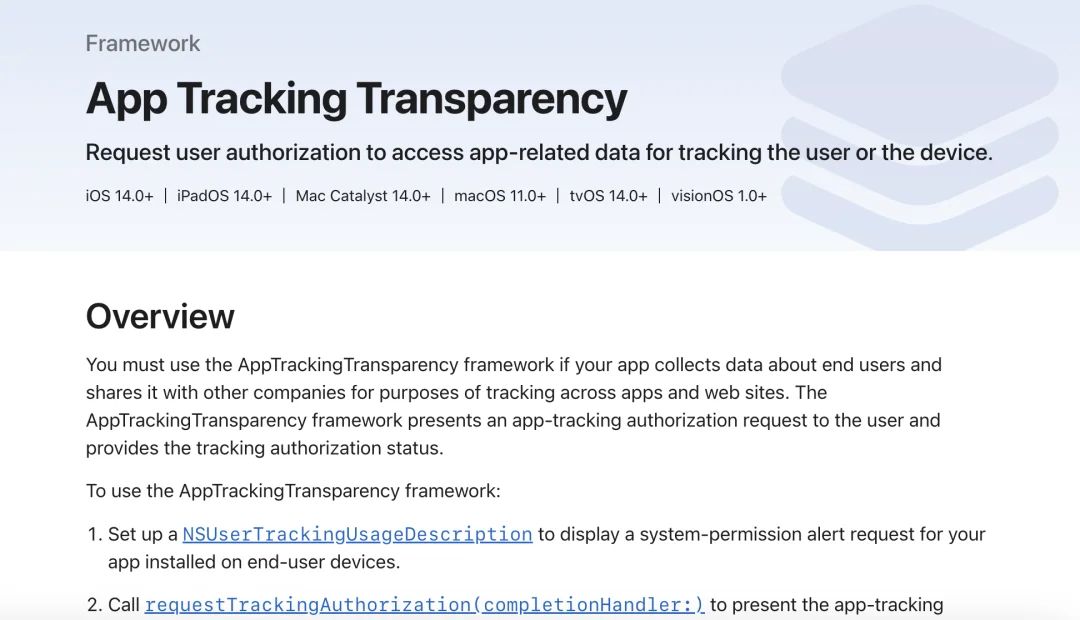

This isn’t Apple’s first time wielding infrastructure as a strategic weapon. Recall App Tracking Transparency (ATT), launched in iOS 14:

- Forced apps to ask permission before tracking users across services.

- 90% of users opted out — crippling Meta’s ad targeting.

- Result: $10B+ in lost Meta revenue, $232B market cap erosion — while Apple’s Search Ads revenue tripled in six months.

ATT succeeded because it was framed as privacy-first — morally unassailable, yet commercially devastating to rivals. It wasn’t about building better ads; it was about controlling the rules of engagement.

The “Blade-in-Sheath” Strategy: Hardware as Neutral Ground

Apple isn’t waiting for AI — it’s engineering the perfect neutral substrate:

✅ Unified Memory Architecture (UMA)

- Selling ultra-expensive RAM (128GB/256GB) — now essential for local LLM inference.

- M-series chips deliver unmatched price/performance for running large models on-device.

✅ MLX Framework

- An open, Apple-optimized framework for running PyTorch-style models on macOS.

- Clear signal to developers: “Run your AI here — not on NVIDIA clouds.”

✅ Dual-Tier OS Policy

| Platform | Policy | Rationale |

|---|---|---|

| iOS | Walled garden — no OpenClaw app allowed | Avoids liability, antitrust exposure, privacy backlash |

| macOS | “General-purpose computer” — full root access, unsigned code | Users bear responsibility; Apple sells hardware, not outcomes |

This separation creates a trust sandbox: Users grant OpenClaw root access on their Mac Mini because the code is open, the hardware is local, and control remains physical — unlike opaque cloud agents.

The Looming Tension: Google’s $20B “Search Tax”

The biggest strategic question isn’t legal risk — it’s economics:

- Google pays Apple ~$20B/year to remain Safari’s default search engine.

- If AI agents bypass search entirely — auto-fetching answers, applying to jobs, summarizing docs — that revenue stream collapses.

🤔 Does Apple prioritize short-term licensing income… or long-term platform sovereignty?

The answer lies in Apple’s history: It chooses structural leverage over rent-seeking — every time.

The New Paradigm: When “Users” Disappear

Web 2.0’s core business model — attention harvesting via friction — is unraveling:

- Instagram wants you to scroll manually → so it can inject ads.

- LinkedIn wants you to log in and click → to serve recruiter listings.

- Google wants you to type queries → to auction keywords.

AI agents disrupt this by eliminating the human loop. They don’t “browse” — they execute. And if half of Instagram traffic becomes bot-driven clicks? That’s indistinguishable from ad fraud.

Yet advertising still dominates:

– Alphabet: 77% of $307B revenue from ads (2023).

– Meta: 97.8% of $134B revenue from ads.

Apple’s genius? It doesn’t need to pick sides. It sells the blade — the trusted hardware foundation — while letting others fight over the blood.

Tactically defensive. Strategically ready. That’s the essence of “blade-in-sheath.”

Article originally published on APPSO.